More tax relief for salaried class announced

Govt slashes tax rate to 1% for individuals earning up to Rs1.2m annually; Warns of legal action against hoarding of solar panels

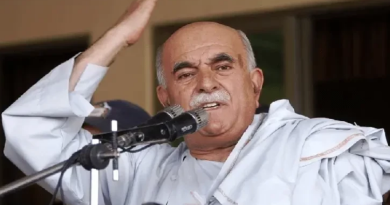

ISLAMABAD: Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb has announced key relief measures in the federal budget for 2025-26, including a significant reduction in income tax for the salaried class and a cut in general sales tax on imported solar panels.

Winding up debate on the finance bill 2025-26 in the Senate on Saturday, Senator Aurangzeb further said that individuals earning between Rs600,000 and Rs1.2 million annually will now be taxed at just 1%, down from 2.5% proposed in the federal budget for FY2025-26.

Aurangzeb expressed the government’s firm commitment to take the country towards inclusive and sustainable economic growth, saying the government exercised fiscal discipline, checked inflation, enhanced foreign exchange reserves and brought improvement in the current account in the outgoing fiscal year.

The finance minister said the budget 2025-26 encompasses measures for the public welfare while maintaining fiscal discipline. He mentioned the federal expenditures have been envisaged to increase by 1.9 percent in the next fiscal year as compared to 10 or 12 percent in previous years.

On the directions of the Prime Minister Shehbaz Sharif, the minister said that income tax rate for those earning between 600,000 rupees and 1.2 million rupees has been reduced from 2.5 percent to one percent. He said salaries have been enhanced by 10 percent and pensions of retired employees by seven percent in the budget.

Aurangzeb said it has also been decided after consultations to reduce sales tax on solar panels to 10 percent from 18 percent. He said the budget of Benazir Income Support Programme has been enhanced to 716 billion rupees from 592 billion rupees.

The minister was appreciative of the Senate Standing Committee on Finance and Revenue’s recommendations on finance bill 2025-26, assuring that about 50 percent of these will be made part of the budget.

Speaking in the Upper House, Aurangzeb said low- and middle-income individuals play a vital role in our economy. “This is the segment that endures inflation and pays taxes,” he acknowledged, saying the proposal to reduce income tax on this salaried class was already part of the budget suggestions.

The minister was of the view that the implementation of a 1% income tax rate is both “a practical and symbolic recognition” by the government that it does not want to burden this class. “We hope this step will not only increase compliance but also restore their confidence in the tax system,” he added.

Aurangzeb reiterated the government did not introduce a mini-budget during the outgoing fiscal year and maintained fiscal discipline. He said the federal government expenditure for FY26 has increased marginally by 1.9%, far lower than in previous years.

Aurangzeb further said the proposed 18% GST on solar panel imports has been slashed to 10 percent following consultations with lawmakers. “The government in its budget proposed to impose an 18% GST on imported solar panels. This was done to protect local industries and provide a level-playing field, and promote the development and investment in solar technology in Pakistan,” he said.

However, in light of detailed deliberations on the budget in both houses, the government has decided to reduce the proposed tax to 10%. Moreover, this tax will apply only to 46% of imported components, said Aurangzeb and added “With this measure, the price of solar panels will increase by 4.6%.”

Aurangzeb informed the house that the government has received reports of profiteering and hoarding of solar panels by certain elements. “It is condemnable that these opportunistic actors have artificially increased prices even before the proposed measure has come into effect. I strongly warn such elements that the government will take every possible step in the public interest,” he said and added legal action will be taken against those involved.

The Senate session was convened with Deputy Chairman Sardar Syedal Khan Nasar presiding. The Upper House concluded its budget debate following seven sittings.

The deliberations centred on a motion moved by Finance Minister Aurangzeb, on June 10, seeking the Senate’s recommendations on the Finance Bill—comprising the Annual Budget Statement—under Article 73 of the Constitution.

Later, the Senate session was prorogued sine die following the adoption of key budget recommendations for onward submission to the National Assembly.

The House adopted the Senate committee’s recommendations on the Federal Budget 2025–26, following the conclusion of the general debate by Finance Minister Aurangzeb.–NNI